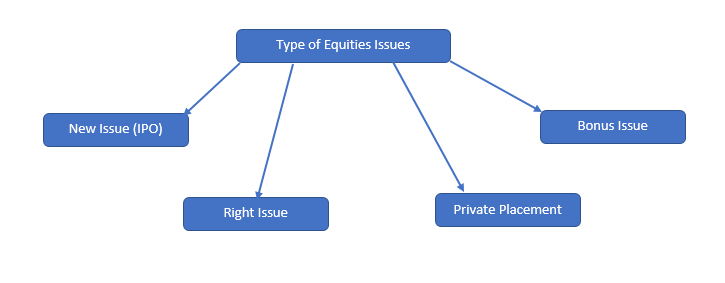

In this article we will see the different type of Equity Issues and their details. Below are the most common type of issues.

1. New Issue (IPO)

2. Right Issue

3. Bonus Issue

4. Private Placement

1.New Issue(IPO):

1.New Issue(IPO):

IPO is the way a firm goes public and sells shares to raise capital. To understand the IPO better I will introduce another term Authorized Share Capital.

Authorized Share Capital: – It is the maximum amount of capital which can be issued by a company.The authorized capital can be increased by the company at any time with shareholders’ approval and by paying additional fee to the Registrar of Companies. For more details click here to access an external.

Before listing, a Company needs to satisfy the prerequisite defined by the respective Primary Market. For more details you can refer NSE website.

A company can only liquidate its share up to Authorized Share Capital and if it want to liquidate further needs to increase its Authorize Share Capital with the help of Registrar of Company.

2. Right Issue:

Right issue is subsequent issue of shares by company to its existing shareholders in the proportion of their holdings. Right issues is allowed only if Company is having sufficient Authorized Share Capital.

Right issues are generally offered at a price below the current market price. Right holders have option either to exercise the right or sell the right to another person. In the right issue company save the charges of broker and underwriter.

3. Private Placement:

Private placement is a capital raising event that involves the sale of securities to a relatively small number of select investors. Investors involved in private placements can include large banks, mutual funds, insurance companies and pension funds. A private placement is different from a public issue in which securities are made available for sale on the open market to any type of investor.

4.Bonus Issue:

Bonus shares are shares distributed by a company to its current shareholders free of charge. Bonus helps company to retain the cash and provide the benefits to the shareholders.