Financial market

I am planing to cover the concepts of Investment banking in a series of ten posts. This first post will cover the

introduction of Financial Market, Money Market, Capital Market, Primary and Secondary Market

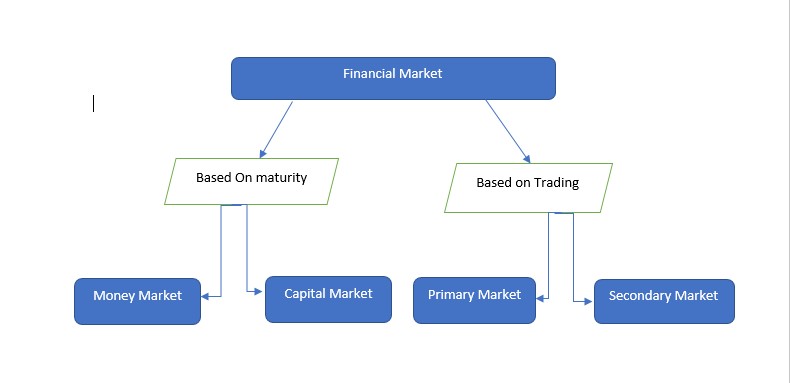

A financial market brings buyer and seller together to trade in financial assets/instruments such as Stocks, Bonds, Commodity, Derivative and Currencies.

The purpose of a financial market is to provide platform for Global trading, raise Capital, maintain Liquidity and to Transfer risk between counter-parties . Two most important category of financial market are :

Two most important category of financial market are :

- Money Market

- Capital Market

Money Market

Money market use to trade on short term basis, usually for the assets maturity upto one year.

Capital Market

Capital Markets are used for long term assets with maturity more than one year. Capital markets includes Equity and Bond Market.

Money Market

Money Market – Liquidity is main purpose for using Money Market. Short term Debt is used for the purpose of covering Operating Expenses or Working Capital for a company or government.

We don’t consider money market for the purpose of Capital Improvement or large projects.

The Money Market is very important for the Corporate and Government as it plays an important role in maintaining the appropriate level of liquidity on daily basis without failing short, without holding excess funds and missing the opportunity of gaining intent on funds. Investors use the money markets to invest the fund in safe manner. This is because the participants of Money Market are big players with high credit worthiness.

For Example:

If ICICI bank needs money for a week they can take a short term loan from other bank like HDFC, SBI or any other bank. The money can be borrowed for 1 day to 1 year. As two stable banks are the counterparties probabilities of default is very less.

Capital Market :

Capital markets are used for long term assets having maturity more than a year which includes equity and Bond market.

On the basis of nature of trade it can categorized in two types :

- Primary

- Secondary

Primary Market –

- Where new equity Stocks or bond issued for the first time are sold to the investors.

- Trade happens between Issuer(Company) and the Investors. For example if DMART is offering IPO Trade will happen between Dmart and the retail Investors.

- Trade in Primary Market directly impacts the Capital of the company.

Secondary Market–

- Secondary Market is a place where primary market instruments, once issued, are bought and sold.

- Trade happens between two counter-parties which does not include the Issuer unless its a buyback.

- Share price in secondary market have no direct impact on company Capital.