Financial Instruments

Corporations need capital to finance business operations. Financial instruments are assets that can be traded. They can also be seen as packages of capital that may be traded.

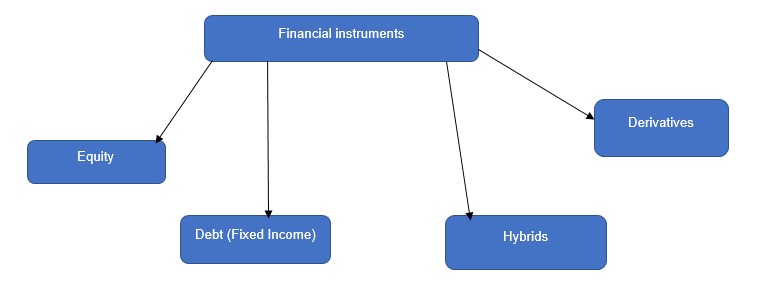

Financial instruments can be classified into:

•Equity

•Debt (or Fixed Income)

•Hybrids

•Derivatives

Equity:- A company’s equity typically refers to the ownership of a public company. For example, investors might own shares of stock in a publicly traded company.

There are two types of equity:

•Common stock

•Preferred stock

Bonds, Debt (Fixed Income) :- The bond is a debt security, under which the issuer owes the holders a debt and (depending on the terms of the bond) is obliged to pay them interest (the coupon) or to repay the principal at a later date, termed the maturity date.

Hybrids:- A hybrid security is a single financial security that combines two or more different financial instruments. Hybrid securities, often referred to as “hybrids,” generally combine both debt and equity characteristics.